EUR/USD: Outlook unchanged due to lacklustre movement. It was a quiet session in the EUR/USD domain Tuesday, with in-line US PPI data doing little to rock the boat. For folks who read Tuesday’s briefing you may recall focus was on further buying from 1.13, targeting 1.1347 (last Friday’s peak) and ultimately 1.14/1.1374 (green – comprised … Continue reading Wednesday 12th June: ECB President Mario Draghi takes centre stage today – remain vigilant.

Category: Recent

Tuesday 11th June: Asian markets gain US Mexico deal.

Global Markets: Asian Stock Markets : Nikkei up 0.35%, Shanghai Composite up 1.95%, Hang Seng up 0.75%, ASX up 1.49% Commodities : Gold at $1332.75 (+0.26%), Silver at $14.70 (+0.40%), Brent Oil at $62.51 (+0.35%), WTI Oil at $53.65 (+0.73%) Rates : US 10-year yield at 2.150, UK 10-year yield at 0.835, Germany 10-year yield … Continue reading Tuesday 11th June: Asian markets gain US Mexico deal.

Tuesday 11th June: Greenback attempting a recovery ahead of PPI numbers.

EUR/USD: Following Friday’s NFP-induced advance, the single currency encountered mild downside pressure Monday amid reports suggesting the European Central Bank (ECB) is mulling further easing. The euro concluded the day down 0.18% versus the US dollar. From a technical standpoint, EUR/USD bulls remain underlining an offensive state out of a long-standing weekly demand zone at … Continue reading Tuesday 11th June: Greenback attempting a recovery ahead of PPI numbers.

Monday 10th June: Asian markets gain on better than expected Chinese trade numbers

Global Markets: Asian Stock Markets : Nikkei up 1.22%, Shanghai Composite up 0.77%, Hang Seng up 2.04% Commodities : Gold at $1331.75 (-1.07%), Silver at $14.78 (-1.69%), Brent Oil at $63.63 (+0.54%), WTI Oil at $54.31 (+0.59%) Rates : US 10-year yield at 2.126, UK 10-year yield at 0.813, Germany 10-year yield at -0.245 News … Continue reading Monday 10th June: Asian markets gain on better than expected Chinese trade numbers

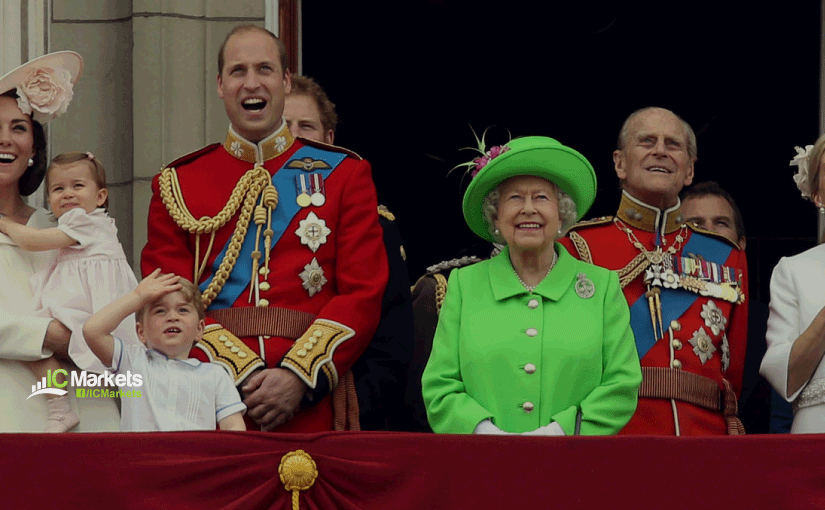

Queen’s Birthday Holiday Trading Schedule 2019

Dear Trader, Please find our updated Trading schedule for the Queen’s Birthday Holiday in Australia on Monday, 10th June 2019. Times mentioned below are Platform time (GMT +3). If you have any questions or require any assistance, please contact one of our support team members via Live Chat, email: support@icmarkets.com, or phone +61 (0)2 8014 4280. Kind regards, IC Markets